Taxpayer User Manual - Corporate Tax Self Registration

Status

Issuing Authority

Effective date

Official Link

Navigating through EmaraTax

The following Tabs and Buttons are available to help you navigate through this process:

|

Button |

Description |

|

In the Portal | |

Introduction

This manual is prepared to help an applicant to navigate through the Federal Tax Authority EmaraTax portal and submit their Corporate Tax Self Registration application. The applicant must be eligible to register for Corporate Tax as per Federal Decree-Law Number 47 of 2022 on the Taxation of Corporations and Businesses.

The applicant can be either a natural person (for example, an Individual), or a legal person (for example, a Public Joint Stock Company, Incorporated, Government Body).

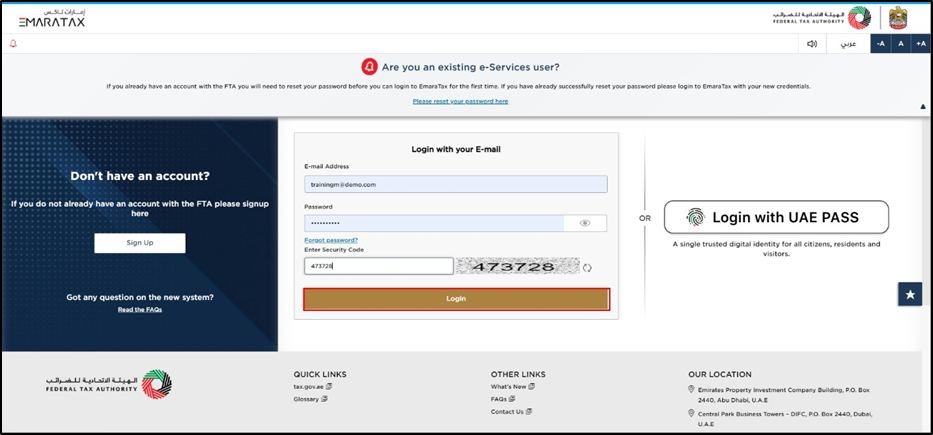

Login to EmaraTax

|

|

You can login into the EmaraTax account using your login credentials or using UAE PASS. If you do not have an EmaraTax account, you can sign-up for an account by clicking the ‘Sign Up’ button. If you have forgotten your password, you can use the 'Forgot password?' feature to reset your password. |

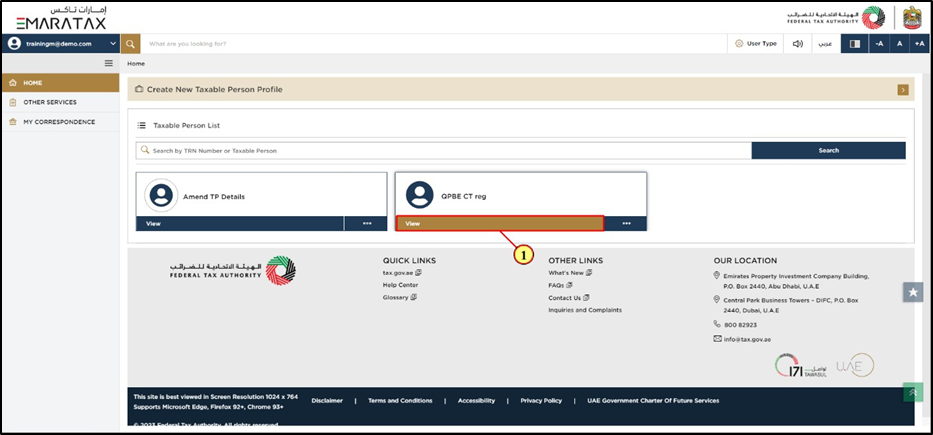

Taxable Person Tile

|

Step |

Action |

|

(1) |

Select the Taxable Person from the list and click 'View' to open the dashboard. |