Taxpayer User Manual Corporate Tax De-Registration

Status

Issuing Authority

Effective date

Official Link

Navigating through EmaraTax

The Following Tabs and Buttons are available to help you navigate through this process

| Button | Description |

| In the Portal | |

The Federal Tax Authority offers a range of comprehensive and distinguished electronic services in order to provide the opportunity for taxpayers to benefit from these services in the best and simplest ways. To get more information on these services Click Here

Introduction

This manual is prepared to help a Corporate Tax registered Taxpayer to navigate through the Federal Tax Authority EmaraTax portal and submit their Corporate Tax De-Registration application. A Taxpayer is eligible to apply to the FTA for De-registration from Corporate Tax based on the following criteria:

- Cessation of Business

- Sale of Business

- Merger of Business

- Redomiciliation of Business

- Any other reasons for Corporate Tax purposes

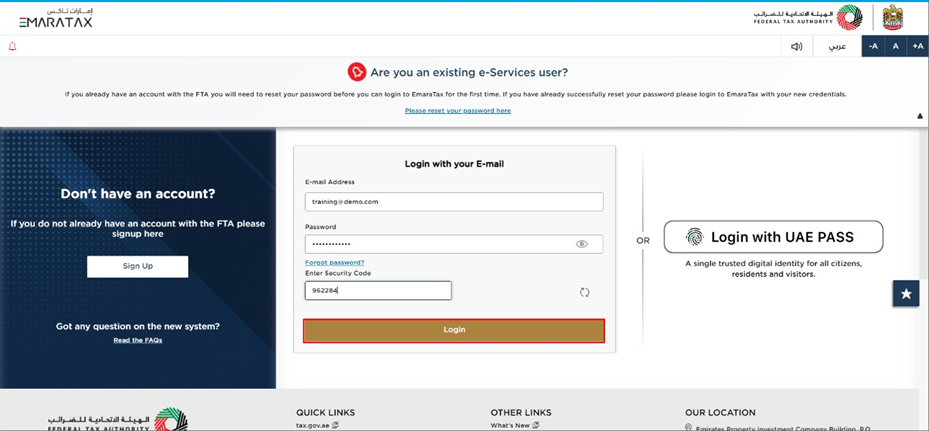

EmaraTax Login Page

|

|

You can login into the EmaraTax account using your login credentials or using UAE Pass. If you do not have an EmaraTax account, you can sign-up for an account by clicking the ‘Sign Up’ button. If you have forgotten your pass... |