Payment User Guide 2022

Status

Issuing Authority

Effective date

Official Link

1. Brief overview of this user guide

This guide will help you to complete payments due to the FTA using any of the following options:

1. Paying via e-Dirham or credit card

2. Paying via Bank Transfer – Local Transfer

3. Paying via Bank Transfer – International Transfer

2. Paying your dues on eServices

2.1 Paying via eDirham or credit card

In order to pay your Tax liabilities, administrative penalties or miscellaneous payments, please follow the instructions given in the example below.

1. Navigate to the tab that displays “My Payments”

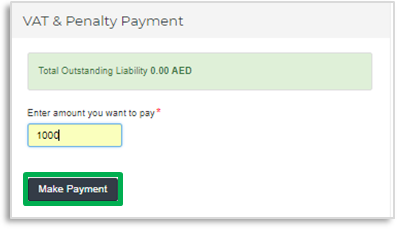

2. Enter the amount you want to pay under the relevant box (Excise Tax or VAT), and click “Make Payment”. Please note that partial payments can be made i.e. you do not have to pay the entire amount due. However, make sure you pay the entire amount before due date to avoid penalty. Older liabilities will be paid off first and then the more recent ones will be fulfilled afterwards.

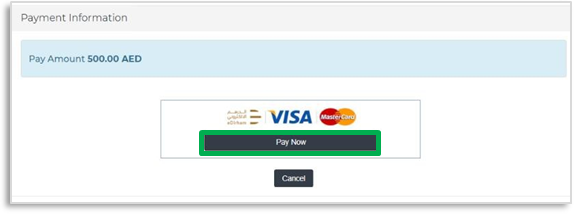

3. You will then be directed to ‘Payment Information’ screen to proceed with the payment. Click on “Pay Now” button to be directed to e-Dirham gateway.

| Note: You may pay using the eDirham payment gateway which supports payments through... |