FTA issued corporate tax clarification on registration timelines for taxable persons

Status

Issuing Authority

Effective date

Official Link

Any taxable person failing to submit a tax registration application within the timeline specified by the FTA will incur an administrative penalty of AED 10,000.

The timelines for registration are set by the Federal Tax Administration Decision No. 3 of 2024 on Registration Timeline for Corporate Tax for the Purposes of Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses.

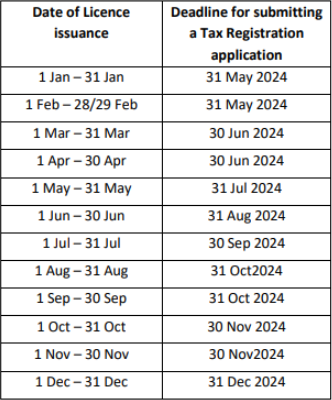

The registration deadline is based on the month of the Licence issuance.

The new clarification explains the different registration deadlines and provides examples of how the deadlines apply to various types of taxable persons.

An overview of some provisions of the Clarification

1. If a juridical resident person was incorporated or otherwise established or recognised prior to 1 March 2024, it shall submit a Tax Registration application for Corporate Tax to the FTA based on the month of their Licence issuance. The application shall be submitted within the time limits as per the table:

|

2. If a juridical resident person was incorporated or otherwise established or recognised on or after to...